UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of the SecuritiesExchange Act of

OF THE SECURITIES EXCHANGE ACT OF 1934 (Amendment

(Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

MUELLER INDUSTRIES, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table | |

| ||

| ||

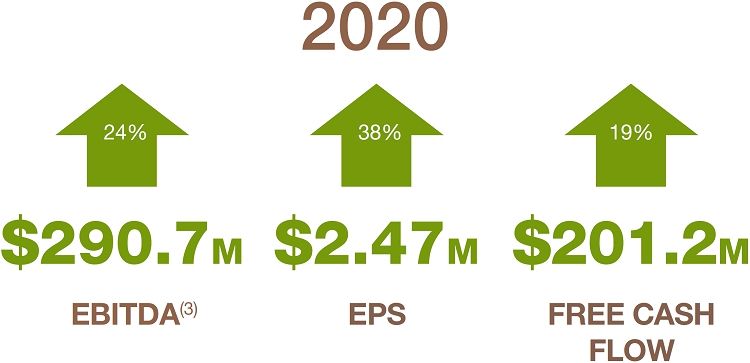

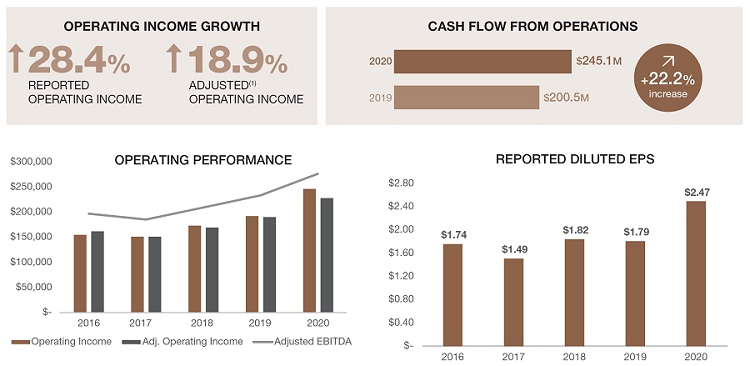

RESULTS AT A GLANCE

| SUMMARY OF OPERATIONS | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| (Dollars in thousands except per share data) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||

| Net Sales | 2,398,043 | 2,430,616 | 2,507,878 | 2,266,073 | 2,055,622 | |||||||||||||||

| SUMMARY OF OPERATIONS (Dollars in thousands except per share data) | 2022 ($) | 2021 ($) | 2020 ($) | 2019 ($) | 2018 ($) | |||||||||||||||

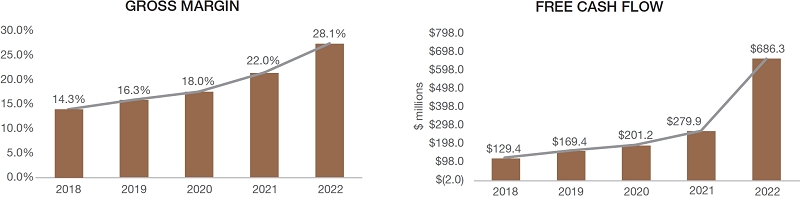

| Net sales | 3,982,455 | 3,769,345 | 2,398,043 | 2,430,616 | 2,507,878 | |||||||||||||||

| Operating income | 245,838 | 191,403 | 172,969 | 150,807 | 154,401 | 877,149 | 655,845 | 245,838 | 191,403 | 172,969 | ||||||||||

| Net income | 139,493 | 100,972 | 104,459 | 85,598 | 99,727 | 658,316 | 468,520 | 139,493 | 100,972 | 104,459 | ||||||||||

| Adjusted EBITDA(1) | 914,507 | 645,535 | 272,399 | 272,399 | 208,590 | |||||||||||||||

| Diluted earnings per share | 2.47 | 1.79 | 1.82 | 1.49 | 1.74 | 11.64 | 8.25 | 2.47 | 1.79 | 1.82 | ||||||||||

| Dividends per share | 0.40 | 0.40 | 0.40 | 8.40(2) | 0.38 | 1.00 | 0.52 | 0.40 | 0.40 | 0.40 | ||||||||||

| SUMMARY OF CASH FLOW | 2020 | 2019 | 2018 | 2017 | 2016 | 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||

| (Dollars in thousands) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||

| Cash Flow from Operations | 245,073 | 200,544 | 167,892 | 43,995 | 157,777 | 723,943 | 311,701 | 245,073 | 200,544 | 167,892 | ||||||||||

| Capital Expenditures | 43,885 | 31,162 | 38,481 | 46,131 | 37,497 | 37,639 | 31,833 | 43,885 | 31,162 | 38,481 | ||||||||||

| Free Cash Flow(1) | 201,188 | 169,382 | 129,411 | (2,136) | 120,280 | |||||||||||||||

| BALANCE SHEET | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Free Cash Flow(2) | 686,304 | 279,868 | 201,188 | 169,382 | 129,411 | |||||||||||||||

| YEAR-END DATA | 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||

| (Dollars in thousands except per share data) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||

| Cash and cash equivalents | 119,075 | 97,944 | 72,616 | 120,269 | 351,317 | |||||||||||||||

| Cash, cash equivalents and ST investments | 678,881 | 87,924 | 119,075 | 97,944 | 72,616 | |||||||||||||||

| Total Assets | 1,528,568 | 1,370,940 | 1,369,549 | 1,320,173 | 1,447,476 | 2,242,399 | 1,728,936 | 1,528,568 | 1,370,940 | 1,369,549 | ||||||||||

| Total Debt | 327,876 | 386,254 | 496,698 | 465,072 | 227,364 | 2,029 | 1,875 | 327,876 | 386,254 | 496,698 | ||||||||||

| Ratio of current assets to current liabilities | 2.4 to 1 | 3.0 to 1 | 3.0 to 1 | 3.1 to 1 | 4.1 to 1 | 4.4 to 1 | 2.7 to 1 | 2.4 to 1 | 3.0 to 1 | 3.0 to 1 | ||||||||||

| Book value per share | 13.61 | 11.30 | 9.67 | 9.03 | 15.66 | 31.42 | 21.33 | 13.61 | 11.30 | 9.67 | ||||||||||

| (1) | ||

| (2) | Free cash flow is a non-GAAP financial measure, which represents cash flow from operations minus capital expenditures. Both cash flow from operations and capital expenditures presented above are as reported in the Company’s Annual | |

| MESSAGE FROM

|   |

Dear Stockholders:

Just2022 was marked by extraordinary market conditions for our industry, and while our team certainly benefitted from some tailwinds, our exceptional results reflect our Company’s fundamental strength and resilience, particularly when faced with challenges and uncertainty.

Mueller’s net sales in 2022 eclipsed $3.98 billion, a 5.7% increase over the previous record set in 2021, led by strength in our North American operations, particularly within our domestic businesses. Most of our U.S. businesses began 2022 where 2021 left off, with demand exceeding industry capacity and historically high backlogs and lead times. We experienced solid demand in our primary end market, building construction, led by residential housing starts nearing a year ago,15-year peak.

We achieved $877 million in reported operating income in 2022, a 33.7% increase over 2021, and our highest ever earnings of $11.64 per diluted share. While record sales played an important role, continued gross margin improvement propelled our profitability. In conjunction with favorable demand, gross margins have grown over the COVID-19 pandemic triggered an unprecedented global health crisis and stopped the world in its tracks. Above all, we would like to extend our deepest gratitudepast five years due to the first respondersfollowing strategic actions:

| • | investments to reduce costs, increase throughput and sustain our operations; |

| • | acquisitions in primary markets and core product lines that have fortified our market positions; and |

| • | the expansion of our portfolio of value-added businesses and products that have higher gross margin profiles. |

Our strong profitability and medical personnel whose heroismworking capital management drove $724 million in cash generated by operations, which enabled us to pay down all debt and sacrifice have assisted so many communities impacted by this terrible virus. We are also grateful forbuild a healthy cash balance to support our capital allocation priorities of reinvestment in our operations, growth through acquisition and proud of our own employees who stepped up to the plate, adapting to new and rapidly evolving conditions to keep our businesses running, so that we could provide the many products that have proven so criticalreturns to our nationalstockholders. In 2022, we increased our annual dividend by 92% to $1.00 per share, and global infrastructure during this difficult period.

Despite the disruption causedwe were very pleased to once again increase our dividend by the pandemic, Mueller delivered solid results in 2020. After adjusting20% for the one-time gain of $22.1 million stemming from our claim in the Deepwater Horizon settlement, which was recorded during the first quarter Mueller still achieved double digit growth over its prior year results in each of these key metrics: earnings, earnings per share (EPS), and cash generation.2023.

These improvements over 2019 were driven by a combination of higher gross marginsOur highest priorities remain the health and SG&A cost containment. As value added products comprised a greater percentagewell-being of our overall revenues,employees and manufacturing costs decreased by 5.6% on a year over year basis, our gross margins improved by 1.7%. Moreover, when news of the pandemic first broke, we undertook aggressive cost-cutting measures, which proved instrumental in reducing costs in all areaslong-term sustainability of our business. AsCompany. In that spirit, and in addition to our day-to-day operational excellence, we successfully executed a result, on a comparative basis, our SG&A expenses declined by 6.4%.number of long-term initiatives in 2022:

Continued reinvestment in our manufacturing platform enabled our plants to be more agile and adapt to the downturn in demand.

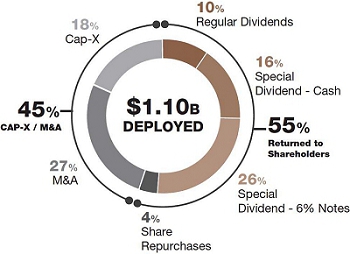

Capital Deployment

Manufacturing is the backbone of our Company, and as such, strategic investment in our operations is not only critical to both workplace safety and product quality, but is also a key component of our core pursuit to be the low cost producer. In 2020, capital project spending totaled $43.9 million, and it was deployed with the care and sense of responsibility that have long characterized our approach to fiscal management. Excluding the $11 million purchase of our headquarters building in Collierville, Tennessee, our spending was slightly below our customary level of capital spending, and well below depreciation. Investment in environmental, health and safety initiatives totaled $8.4 million, and helped us reduce emissions, conserve more water and energy, and increase the amount of recycled material used in production. Of the remaining spend, $14.4 million was directed at two projects that will support our long term strategic plan and help deliver meaningful efficiencies in future years.

In 2020, we deployed $72.6 million to complete two strategic acquisitions. Integral to our growth strategy is the pursuit of acquisitions that are complementary to businesses we know and operate, including the two acquisitions we closed this past year.

2016-2020 CAPITAL ALLOCATION

| • | Since we began reporting our safety performance 15 years ago, we achieved our lowest three-year average Total Incidence Rate (TIR). In 2022, our legacy mill businesses had their lowest ever level of OSHA recordable incidents. |

| • | Following years of underperformance when we held a minority interest, our Middle East copper tube mill was successfully restructured under our control and is now profitable. |

| We launched our patented line of air conditioning and refrigeration (ACR) press fittings, thereby completing an intense, six-year design and development process. Skilled labor remains a concern for our contractor base, and as such, the expansion of mechanical press technology will greatly benefit the air conditioning and refrigeration sector. | |

| • | We completed the installation of a new copper scrap refiner in our United Kingdom copper tube mill. The startup was delayed due to regulatory hurdles, but we are now in the commissioning phase. The refiner will reduce costs and our carbon footprint, while also providing the site with ample raw material for production. |

| • | In late August, a fire completely destroyed our Westermeyer manufacturing operations. Nonetheless, our employees showcased their resilience by working from makeshift operations, and Westermeyer was back at 85% capacity by year-end. Our new plant is expected to be completed during the second quarter of 2023, and Westermeyer will be stronger than ever before. |

Sustainability

| • | In line with our continued commitment to environmentally sustainable business practices and social responsibility, we expanded upon our ESG reporting initiatives and disclosed our Scope 2 emissions in our annual Sustainability Report. We also completed the work necessary to publish our Scope 3 emissions, and will do so in 2023. |

| • | In September, we launched an enhanced investor website and published our first investor presentation. These materials provide our stakeholders with an in-depth view of our operating principles and business transformation, along with a better understanding of our strengths, value proposition and strategic priorities going forward. |

OurAs we head into 2023, we recognize that economic conditions are changing. The continued rise in interest rates, combined with elevated tensions across the globe, will give rise to further challenges. We anticipate that U.S. residential building markets will decline compared to 2022. Notwithstanding, the housing market remains underserved, and as such, we believe that demand levels will remain reasonably healthy relative to industry capacity. Other important sectors remain strong, financialincluding commercial construction, refrigeration, transportation and operating performance aside,infrastructure, particularly related to water transmission and quality. On the measure of any company’s success extendsinternational front, we believe that conditions have bottomed out after a difficult 2022, and that our businesses are therefore well beyond the numbers. Increasingly, we also evaluate our Company’s progress based on its contribution to the sustainability of the local communities in which we operate, and the world at large. Sustainability has many components, and we view the associated risks and opportunities through the widest lens. Looking inward, we take the necessary actions to ensure we provideprepared for a safe and healthy working environment for our people, as well as opportunities for professional growth and development. Looking outward, we consider how our decisions both impact and contribute to the communities in which we operate. We also consider how our decisions affect the various systems, both natural and technological, that sustain our living planet, and the impact the continued functioning of these systems may have on our ability to operate long term.rebound.

We are happyhave many pillars of strength to report that in 2020,draw upon, and foremost among them is our balance sheet. With no debt and ample cash reserves, we again made positive strides in the environmental, socialcan and governance (ESG) measures that are of increasing importance to our stockholders. Importantly, we greatly improved our safety performance, achieving a 16% reduction in accidents per man hour worked, with zero “major” OSHA recordable incidences. Since we began measuring them in 2010, we have reduced OSHA recordable incidences by 65% in our core businesses. Accounting for acquisitions during this same timeframe, our incidence rate has decreased by 35%.

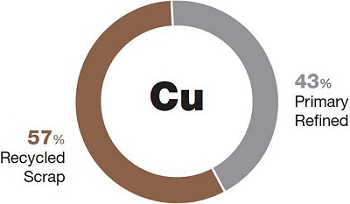

As an industrial manufacturer, we devote a great amount of attention to environmental compliance. In 2020, our North American operations reduced greenhouse gas emissions by 9.5% on a per unit basis, and reduced energy consumption by 15.6% on a per unit basis. Moreover, we continue to utilize a majority of recycled scrap in our manufacturing process, 66% in 2019 and 57% in 2020.

RECYCLED CONTENT

We continue to seek alternative processing methodologies to increase our consumption percent of recycled materials. Using recycled copper significantly reduces the energy and water consumption that results from the mining process, and also mitigates the related environmental impacts that are otherwise incurred when raw material imports and unconsumed scrap exports must travel long distances.

Financial Conditions

At the close of 2020, the Company’s market capitalization was $1.98 billion. This equates to 6.8 times EBITDA and 8.0 times cash from operations. We held $119 million in cash, and had a total debt balance of $327 million. We recently announced our plan to redeem the $284 million in outstanding debentures due in 2027, along with a 30% increase in our dividend. At this time, I am pleased to report that the Company is in excellent financial shape and has ample liquidity and cash flows not only to operate our businesses, but also to pursue our continued growth plans both organically and through acquisitions.

Going Forward

The pandemic has impacted all global economies. With the arrival of vaccines, in record time, we anticipate that we will see reopenings and a return of demand in almost all businesses in the near future. In particular, residential building markets on a global basis remain underserved, and we expect expansion in home construction to help drive economic recoveries. Construction is an important determinant of demand for many of our products.

In addition, we are optimistic that in 2021 and beyond, we will continue to see increased demand for productsinvest in our operations and technologies aimed at clean water distribution, indoor air qualityto act decisively when opportunities arise. Other key advantages include our decentralized structure, diverse portfolio, sustainable operations, and climate comfort, refrigerationmost of all, our talented employees who make it all happen. With origins dating back more than a century, time and food preservation,again, our Company has proven its ability to persevere through challenges and energy storage and transmission. These all are important end markets, and will remain a focus as we consider growth opportunities.emerge even stronger than before. We plan to continue that tradition in the year ahead.

Our approach isOnce again, I want to set lofty goals and drive hardexpress my appreciation to exceed them. Our 2024 Plan calls for double digit compounded annual growth in operating income over a six-year period. As it did in 2019, our operating income growth in 2020 has kept us on track to achieve that Plan. Given the unprecedented challenges we confronted, our results are a testament to the strength of our Company, and the adaptability of those who work tirelessly on its behalf.

We remain optimistic about the future and once again thank our valueddedicated employees, loyal customers and of course, ourvalued stockholders for their confidence and continued support.

Very truly yours,

Greg Christopher

Chairman and Chief Executive Officer& CEO

THURSDAY, MAY 6, 20214, 2023

10:8:00 A.M., Central Time

150 Schilling Boulevard,

Second Floor

Collierville, Tennessee 38017

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||

BY INTERNET http://www.proxyvote.com |  |  | ||

BY TELEPHONE |  | |||

Call the telephone number on your proxy card. |  | |||

BY MAIL |  | |||

Mark, date, sign and return your | ||||

proxy card in the enclosed |  | |||

IN PERSON |  | |||

Attend the Annual meeting at the Company’s headquarters. |  | |||

| It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you intend to be present at the meeting in person, we urge you to mark, date and sign the enclosed proxy card and return it in the enclosed self-addressed envelope, which requires no postage if mailed in the United States. | ||||

| |||

NOTICE of Annual Meeting | |||

NOTICEof Annual Meetingof Stockholders

PURPOSE To vote on | |

| 1. | To elect eight directors, each to serve on the Company’s Board of Directors (the “Board”), until the next annual meeting of stockholders (tentatively scheduled for May |

| 2. | To consider and act upon a proposal to approve the appointment of Ernst & Young LLP, independent registered public accountants, as auditors of the Company for the fiscal year ending December 30, 2023; |

| 3. | To conduct an advisory vote on the compensation of the Company’s named executive officers (“NEOs”) ; and |

| 4. | To conduct an advisory vote on the frequency with which the Company should hold future advisory votes on the compensation of the Company’s NEOs. |

| To conduct and transact such other business as may properly be brought before the Annual Meeting and any adjournment thereof. | |

RECORD DATE

Only stockholders of record at the close of business on March 19, 2021,13, 2023, will be entitled to notice of and vote at the Annual Meeting or any adjournment(s) thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be prepared and maintained at the Company’s corporate headquarters at 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. This list will be available for inspection by stockholders of record during normal business hours for a period of at least 10 days prior to the Annual Meeting.

/s/ Christopher J. Miritello

Christopher J. Miritello

Corporate Secretary

April 1, 2021

March 23, 2023

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 76

| PROXY SUMMARY |

THIS SUMMARY HIGHLIGHTS SELECTED INFORMATION IN THIS PROXY STATEMENT. PLEASE REVIEW THE ENTIRE PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K BEFORE VOTING YOUR SHARES.

| — | INFORMATION ABOUT VOTING AND THE ANNUAL MEETING |

Adjusted operating incomeNotice of the availability of this Proxy Statement, together with the Company’s Annual Report for the fiscal year ended December 31, 2022, is first being mailed to stockholders on or about March 23, 2023. Pursuant to rules adopted by the Securities and adjusted EBITDA are non-GAAP financial measures which exclude certain items in orderExchange Commission, the Company is providing access to better reflect results of on-going operations. See Appendix A for a reconciliation of non-GAAP financial measures to our results reported under GAAP.its proxy materials over the Internet at http://www.proxyvote.com.

When a proxy card is returned properly signed, the shares represented thereby will be voted in accordance with the stockholder’s directions appearing on the card. If the proxy card is signed and returned without directions, the shares will be voted for the nominees named herein and in accordance with the recommendations of the Company’s Board of Directors as set forth herein. A stockholder giving a proxy may revoke it at any time before it is voted at the Annual Meeting by giving written notice to the secretary of the Annual Meeting or by casting a ballot at the Annual Meeting. Votes cast by proxy or in person at the Annual Meeting will be tabulated by election inspectors appointed for the Annual Meeting. The election inspectors will also determine whether a quorum is present. The holders of a majority of the shares of common stock, $.01 par value per share (“Common Stock”), outstanding and entitled to vote who are present either in person or represented by proxy will constitute a quorum for the Annual Meeting.

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, directors, officers and employees of the Company may solicit proxies by telephone or otherwise. The Company will reimburse brokers or other persons holding stock in their names or in the names of their nominees for their charges and expenses in forwarding proxies and proxy material to the beneficial owners of such stock.

Record Date: March 13, 2023

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 87

| — |

|

| (1) | Adjusted operating income and adjusted EBITDA are non-GAAP financial measures which exclude certain items in order to better reflect results of on-going operations. See Appendix A for a reconciliation of non-GAAP financial measures to our results reported under GAAP. |

|  ANNUAL MEETING OF STOCKHOLDERS |

|   |  |

| Date and Time: | Place: | Record Date: |

| Thursday, May | 150 Schilling Boulevard | March |

| Second Floor | ||

| Collierville, Tennessee 38017 |

| — | AGENDA AND VOTING MATTERS |

We are asking you to vote on the following proposals at the Annual Meeting:

| Proposal | Board Recommendation | Page Reference |

| Proposal 1 – Election of Directors | FOR each nominee | 11 |

| Proposal 2 – Approval of Auditor | FOR | 21 |

| Proposal 3 – Say-on-Pay | FOR | 23 |

| Proposal 4 – Say-on-Frequency | EVERY YEAR | 44 |

MUELLER INDUSTRIES● 2023 PROXY STATEMENT 8

| — | PROPOSAL 1: ELECTION OF DIRECTORS |

The following table provides summary information about each director nominee. The Board of Directors believes that these nominees reflect an appropriate composition to effectively oversee the performance of management in the execution of the Company’s strategy, and as such, recommends a vote “for” each of the eight nominees listed below.

| Name | Age | Director Since | Primary Occupation | Independence | Committee Memberships | Current Other Public Boards | Age | Director Since | Primary Occupation | Independence | Committee Memberships | Current Other Public Boards | ||||||||||||

| Gregory L. Christopher Chairman and Chief Executive Officer | 59 | 2010 | Chief Executive Officer, Mueller Industries, Inc. | N | None | None | 61 | 2010 | Chief Executive Officer, Mueller Industries, Inc. | N | None | None | ||||||||||||

| Elizabeth Donovan | 68 | 2019 | Retired, Chicago Board Options Exchange | Y | NCG | None | 70 | 2019 | Retired, Chicago Board Options Exchange | Y | N* | None | ||||||||||||

| Gennaro J. Fulvio | 64 | 2002 | Member, Fulvio & Associates, LLP | Y | A* | None | ||||||||||||||||||

| William C. Drummond | 69 | 2022 | Principal, The Marston Group PLC | Y | A | None | ||||||||||||||||||

| Gary S. Gladstein | 76 | 2000 | Private Investor, Consultant | Y | C* | None | 78 | 2000 | Private Investor, Consultant | Y | C | None | ||||||||||||

| Scott J. Goldman | 68 | 2008 | Chief Executive Officer, TextPower, Inc. | Y | A, C | None | 70 | 2008 | Chief Executive Officer, TextPower, Inc. | Y | C*, N | None | ||||||||||||

| John B. Hansen | 74 | 2014 | Retired Executive Vice President, Mueller Industries, Inc. | Y | A, NCG | None | 76 | 2014 | Retired Executive Vice President, Mueller Industries, Inc. | Y | A*, N | None | ||||||||||||

| Terry Hermanson Lead Independent Director since January 1, 2019 | 78 | 2003 | Principal, Mr. Christmas Incorporated | Y | None | None | 80 | 2003 | Principal, Mr. Christmas Incorporated | Y | C | None | ||||||||||||

| Charles P. Herzog, Jr. | 64 | 2017 | Co-Founder and Principal, Atadex LLC & Vypin LLC | Y | C, NCG* | None | 65 | 2017 | Co-Founder and Principal, Atadex LLC & Vypin LLC | Y | A | None | ||||||||||||

A = Audit Committee

C = Compensation and Stock OptionPersonnel Development Committee

NCGN = Nominating and Corporate Governance Committee

* = Chair

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 9

| Director Experiences and Skills | |||||

| Financial Reporting |  | International Business |  | Manufacturing/Industries |

| Supply Chain/Logistics |  | Technology/Cybersecurity |  | Equity Markets/Securities |

PROPOSAL 2: RATIFICATION OF INDEPENDENT AUDITORS |

We ask our stockholders to approve the selection of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 25, 2021.31, 2022. Below is summary information about fees paid to EY for services provided in 20202022 and 2019:2021:

| 2020 | 2019 | |||||||

| Audit Fees | $ | 2,749,755 | $ | 2,856,774 | ||||

| Audit-Related Fees | 47,000 | 50,250 | ||||||

| Tax Fees | 406,000 | 422,350 | ||||||

| All Other Fees | — | — | ||||||

| $ | 3,202,755 | $ | 3,329,374 | |||||

| 2022 | 2021 | |||||||

| Audit Fees | $ | 3,298,330 | $ | 3,096,955 | ||||

| Audit-Related Fees | $ | 53,000 | $ | 74,000 | ||||

| Tax Fees | $ | 617,000 | $ | 660,000 | ||||

| All Other Fees | — | — | ||||||

| $ | 3,968,330 | $ | 3,830,955 | |||||

MUELLER INDUSTRIES●��2023 PROXY STATEMENT 9

| — | PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF |

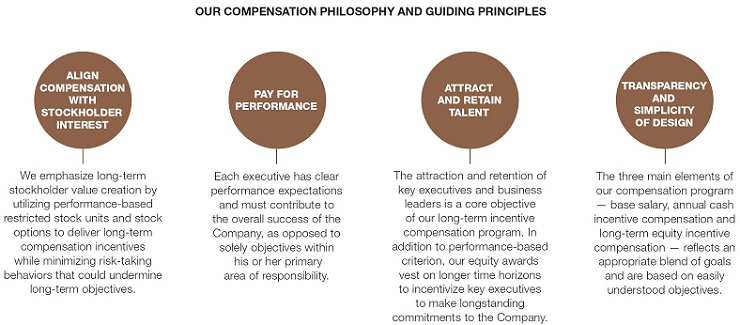

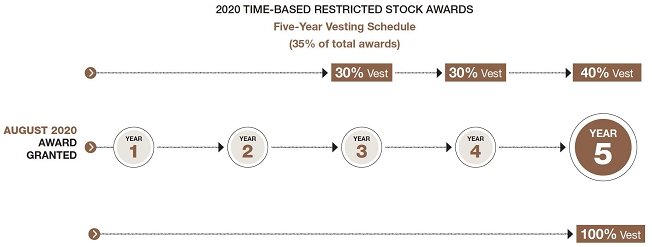

We are seeking your advisory vote to approve the compensation of our named executive officers as disclosed in this proxy statement. Our executive officers are responsible for achieving long-term strategic goals, and as such, their compensation is weighted toward rewarding long-term value creation for stockholders. Beyond base salary and traditional benefits, we maintain an annual cash incentive compensation program that is driven by a pay-for-performance philosophy and based on ambitious performance targets both at the Company and business line levels. We also maintain a long-term equity incentive compensation program, the primary objective of which is to motivate and retain top talent — a particularly vital goal given the uniquely competitive industry in which we operate. Accordingly, we utilize a combination of extended time-vesting schedules and performance-based vesting criteria to encourage executives and associates alike to enjoy lengthy tenures at the Company, develop industry expertise and relationships, ensure sound transition and succession planning, and drive our long-term success.

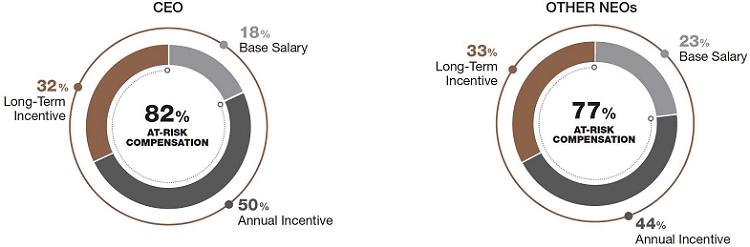

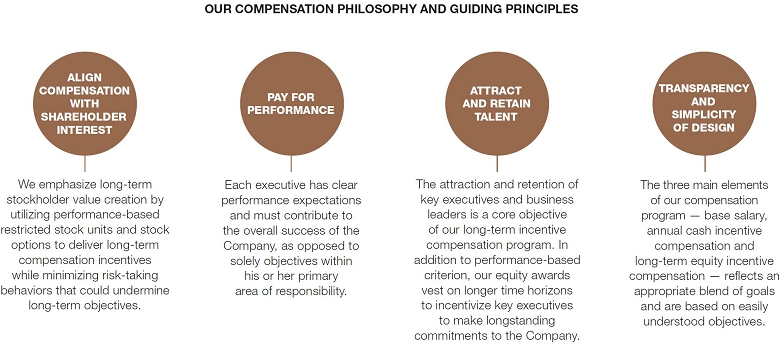

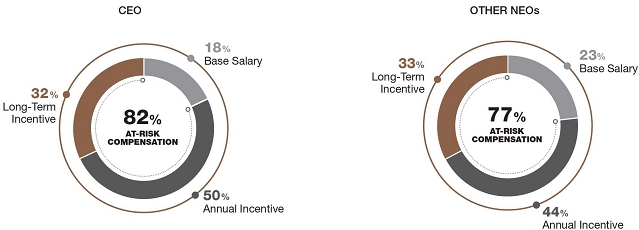

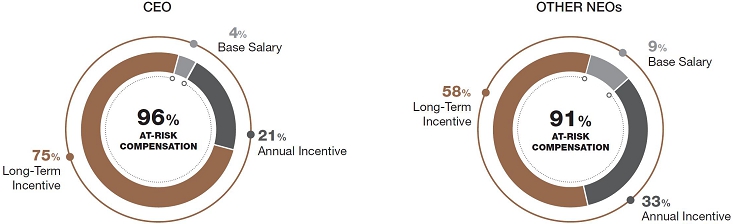

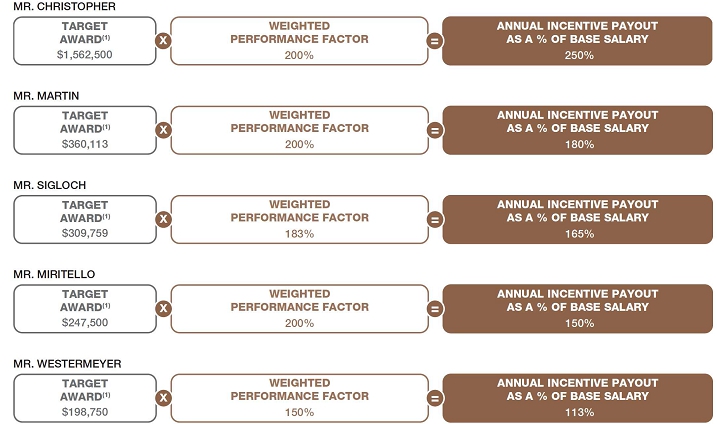

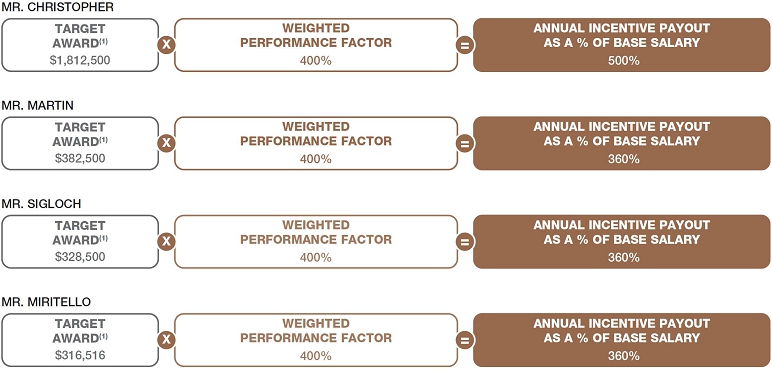

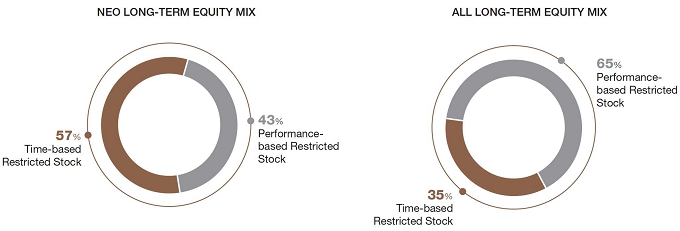

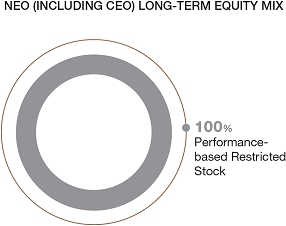

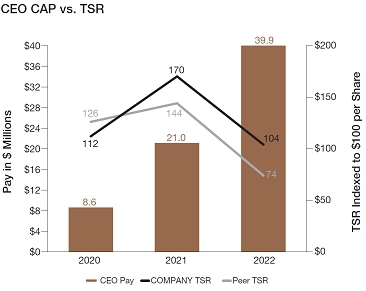

Our emphasis on creating long-term stockholder valuea pay for performance compensation model is best illustrated in the following charts, which show that long-term incentive compensation accounts for the largest percentage of the NEOs’ overall compensation for 2020. Moreover,in 2022, a substantial majority of theour NEOs’ overall compensation — consisting of target long-term and short-term incentive compensation combined — is performance-based or “at risk.”

| — | PROPOSAL 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE STOCKHOLDER ADVISORY VOTES TO APPROVE NEO COMPENSATION |

We are seeking your advisory vote on the frequency of future stockholder advisory votes to approve the compensation of our NEOs. The Board of Directors believes that an annual advisory vote on NEO compensation will give the Company’s stockholders the best opportunity to provide the Company with direct input each year on the Company’s compensation philosophy, policies and practices as disclosed in the Proxy Statement. Although the stockholder vote on the frequency of advisory votes on NEO compensation is not binding on the Board of Directors or the Company, the Board of Directors and the Compensation and Personnel Development Committee will review the voting results in determining the frequency of future votes.

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 10

|

|

— PROPOSAL 1: ELECTION OF DIRECTORS

Eight director nominees will be elected at the Annual Meeting, each to serve until the next annual meeting (tentatively scheduled for May 5, 2022)9, 2024), or until the election and qualification of their successors. At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following persons to serve as directors for the term beginning at the Annual Meeting: Gregory L. Christopher, Elizabeth Donovan, Gennaro J. Fulvio,William C. Drummond, Gary S. Gladstein, Scott J. Goldman, John B. Hansen, Terry Hermanson and Charles P. Herzog, Jr. (collectively, the “Nominees”).

Directors are elected by a plurality of the votes cast, which means that the individuals who receive the greatest number of votes cast “For” are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. Consequently, any shares not voted “For” a particular director (whether as a result of a direction to withhold or a broker non-vote) will not be counted in such director’s favor.

The Board of Directors has adopted a majority vote policy in uncontested elections. An uncontested election means any stockholders meeting called for purposes of electing any director(s) in which (i) the number of director nominees for election is equal to the number of positions on the Board of Directors to be filled through the election to be conducted at such meeting, and/or (ii) proxies are being solicited for the election of directors solely by the Company.

The election of directors solicited by this Proxy Statement is an uncontested election. In the event that a nominee for election in an uncontested election receives a greater number of votes “Withheld” for his or her election than votes “For” such election, such nominee will tender an irrevocable resignation to the Nominating and Corporate Governance Committee, which will decide whether to accept or reject the resignation and submit such recommendation for prompt consideration by the Board of Directors no later than ninety (90) days following the uncontested election.

— SELECTING NOMINEES TO THE BOARD

| — | SELECTING NOMINEES TO THE BOARD |

The Nominating and Corporate Governance Committee considers, among other things, the following criteria in selecting and reviewing director nominees:

| • | personal and professional integrity, and the highest ethical standards; |

| • | skills, business experience and industry knowledge useful to the oversight of the Company based on the perceived needs of the Company and the Board at any given time; |

| • | the ability and willingness to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings; |

| • | the interest, capacity and willingness to serve the long-term interests of the Company; and |

| • | the lack of any personal or professional relationships that would adversely affect a candidate’s ability to serve the best interests of the Company and its stockholders. |

The Nominating and Corporate Governance Committee also assesses the contributions of the Company’s incumbent directors in connection with their potential re-nomination. In identifying and recommending director nominees, the Committee members take into account such factors as they determine appropriate, including recommendations made by the Board of Directors.

As reflected in its formal charter, the Nominating and Corporate Governance Committee considers the diversity of the Company’s Board and employees to be a tremendous asset. The Company is committed to maintaining a highly qualified and diverse Board, and as such, all candidates are considered regardless of their age, gender, race, color of skin, ethnic origin, political affiliation, religious preference, sexual orientation, country of origin, physical handicaps or any other category.

Through Charter amendments enacted in February, the Nominating and Governance Committee reaffirmed its commitment to including, in each search, qualified candidates who reflect diverse backgrounds, including diversity of gender and race. Moreover, the Committee will consider all candidates irrespective of whether their backgrounds includes work in the corporate, academic, government or non-profit sectors. These efforts to promote diversity are assessed annually to assure that the Board contains a balanced and effective mix of individuals capable of advancing the Company’s long-term interests.

The Nominating and Corporate Governance Committee does not consider individuals nominated by stockholders for election to the Board. The Board believes that this is an appropriate policy because the Company’s Restated Certificate of Incorporation and Amended and Restated By-laws (“Bylaws”) allow a qualifying stockholder to nominate an individual for election to the Board, said nomination of which can be brought directly before a meeting of stockholders. Procedures and deadlines for doing so are set forth in the Company’s Bylaws, the applicable provisions of which may be obtained, without charge, on the Company’s website or upon written request to the Secretary of the Company at the address set forth herein.

The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the procedures set forth in the Bylaws. See “Stockholder Nominations for Board Membership and Other Proposals for 20212023 Annual Meeting.”

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 11

— DIRECTOR NOMINEE BIOGRAPHIES

| — | DIRECTOR NOMINEE BIOGRAPHIES |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTETHEIR SHARES FOR EACH OF THE NOMINEES. |

| GREGORY L. CHRISTOPHER | |

| Chairman of the Board and Chief Executive Officer | |

| Age 61 Director Since 2010 | Mr. Christopher has served as Chairman of the Board of Directors since January 1, 2016. Mr. Christopher has served as Chief Executive Officer of the Company since October 30, 2008. Prior to that, he served as the Company’s Chief Operating |

| ELIZABETH DONOVAN | |

| Age 70 Director Since 2019 | Ms. Donovan was an early member, and at the time, one of the few women on the Chicago Board Options Exchange. She subsequently became an independent broker representing major institutional options orders and has been retired from employment for more than five years. |

| Ms. Donovan was nominated to serve as a director of the Company because of her knowledge of market dynamics andinstitutional trading practices, knowledge acquired through her 18-year tenure as a fiduciary representative amidst an array of market conditions. She currently serves | |

| Age 69 Director Since | Mr.

Mr. |

| GARY S. GLADSTEIN | |

| Age 78 Director Since2000 | Mr. Gladstein served as Chairman of the Board of Directors of the Company from 2013 to 2015, and was previously a director of the Company from 1990 to 1994. Mr. Gladstein is currently an independent investor and consultant. From the beginning of 2000 to August 31, 2004, Mr. Gladstein was a Senior Consultant at Soros Fund Management. He was a partner and Chief Operating Officer at Soros Fund Management from 1985 until his retirement at the end of 1999. During the past five years, Mr. Gladstein also served as a director of Inversiones y Representaciones Sociedad Anónima, Darien Rowayton Bank and a number of private companies.

Mr. Gladstein was nominated to serve as a director of the Company because of his financial and accounting expertise,combined with his years of experience providing strategic advisory services to complex organizations. In addition, havingbeen a member of the compensation, audit and other committees of public company boards, Mr. Gladstein is deeply familiarwith corporate governance issues. He currently serves |

| SCOTT J. GOLDMAN | |

| Age 70 Director Since2008 | For

Mr. Goldman was nominated to serve as a director of the Company because of his extensive experience with cybersecurity,advanced technologies and global market strategies. He currently serves |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 12

| JOHN B. HANSEN | |

| Age 76 Director Since2014 | Prior to his retirement as an Executive Vice President of the Company in 2014, Mr. Hansen served the Company in a variety of roles, including President-Plumbing Business, President-Manufacturing Operations and Senior Vice President – Strategy and Industry Relations.

Mr. Hansen was nominated to serve as a director because of his extensive industry experience and deep knowledge of theCompany, its full array of operations and the global markets it serves. He currently serves |

| TERRY HERMANSON | |

| Lead Independent Director | |

| Age 80 Director Since2003 | Mr. Hermanson has been the principal of Mr. Christmas Incorporated, a wholesale merchandising company, since 1978, and presently serves as its Chairman.

Mr. Hermanson was nominated to serve as a director of the Company because of his extensive experience in |

| CHARLES P. HERZOG, JR. | |

| Age 65 Director Since2017 | Since 2010, Mr. Herzog has been a principal at Atadex LLC, a firm he co-founded. He co-founded a second firm, Vypin LLC, in 2016. Atadex and Vypin provide advanced technological and data delivery solutions to support the transportation logistics industry.

Mr. Herzog was nominated to serve as a director of the Company based on his extensive knowledge of the transportationlogistics industry, and the developing technologies that support it. He currently serves |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 13

| CORPORATE GOVERNANCE |

The Company adheres

Our Board of Directors’ commitment to an established set ofsound governance practices is embodied in its Corporate Governance Guidelines, for purposes of defining director independence, assigning responsibilities, setting high standards of professional and personal conduct, and ensuring compliance with such responsibilities and standards. Such Guidelineswhich are periodically reviewed in light of evolving trends, in corporate governance standards, regulations and related disclosure requirements, particularly as adopted byrequirements. These practices include the NYSE and (with respect to the Audit Committee (the SEC)).following:

| Board Independence | • Seven of our eight director nominees are independent. • Our CEO is our only management director. |

| Board Composition | • All Board members are elected annually. • The Board annually evaluates its performance and the performance of its committees. |

| Board Committees | • We have three committees: Audit; Compensation and Personnel Development; and Nominating and Governance. • All committees are composed entirely of independent directors. |

| Leadership Structure | • Our Board has a Lead Independent Director who liaises between our CEO & Chairman and other directors. • Among other duties, our Lead Independent Director chairs executive sessions of our independent directors. |

| Environmental, Social &Governance (ESG) Oversight | • Our Nominating & Governance Committee oversees our ESG program, and delegates suchresponsibilities to other committees, subcommittees or the full Board as necessary. |

| Open Communication | • We encourage open communication and strong working relationships among the Lead Independent Director, Chairman and other directors. • Our directors have direct access to management. |

| Stock Ownership | • Our directors are subject to stock ownership requirements. |

In order for a director to qualify as “independent,” our Board of Directors must affirmatively determine, consistent with NYSE rules, that the director has no material relationship with the Company that would impair the director’s independence. Our Board of Directors undertook its annual review of director independence in February 2021.2023. In applying the NYSE standards for independence, and after considering all relevant facts and circumstances, the Board of Directors has affirmatively determined that all directors, with the Company’s current “independent” directors are: Elizabeth Donovan, Gennaro J. Fulvio, Gary S. Gladstein, Scott J. Goldman, John Hansen, Terry Hermanson and Charles P. Herzog, Jr.exception of Mr. Christopher, are “independent.” In the course of the Board of Directors’ determination regarding the independence of each non-management director, the Board considered for:

| • | Mr. Drummond, the fact that although he was previously a partner with Ernst & Young LLP (“EY”), the Company’s independent auditing firm, he retired from EY in 2012, and the Company has received written confirmation from EY that (i) all independence issues related to his service on the Company’s Board of Directors have been resolved, (ii) Mr. Drummond would not be receiving any unfunded retirement benefits from EY, and (iii) all other non-pension related financial ties and firm amenities had been settled. |

| • | Mr. Hansen, the fact that while he was previously an executive officer of the Company (until his retirement on April 30, 2014), more than five years have lapsed since the termination of his employment relationship with the Company. |

—

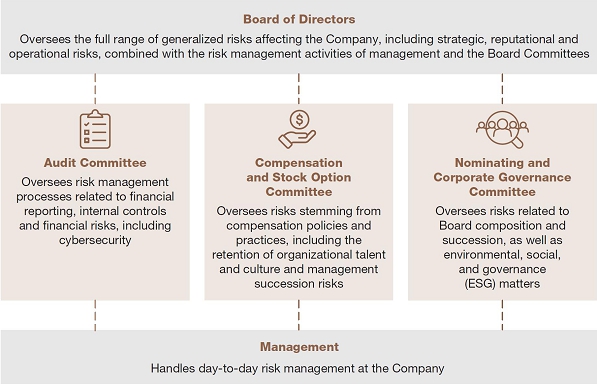

BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors and its committees meet regularly throughout the year, and may also hold special meetings and act by written consent from time to time. In 2020,2022, the Board of Directors held four regularly scheduled meetings and one special meeting.meetings. During this time, our directors attended 100% of our Board of Directors meetings and meetings of the committees on which they served. The Company’s Corporate Governance Guidelines provide that the Company’s non-management directors shall hold annually at least two formal meetings independent from management. Our Lead Independent Director presides at these executive sessions of the Board of Directors.

MUELLER INDUSTRIES● 2023 PROXY STATEMENT 14

Three standing committees have been convened to assist the Board of Directors with various functions: the Audit Committee, the Compensation and Stock OptionPersonnel Development Committee, and the Nominating and Corporate Governance Committee. Each committee operates pursuant to a formal charter that may be obtained, free of charge, at the Company’s website at www.muellerindustries.com, or by requesting a print copy from our Corporate Secretary at the address listed herein.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 14

| AUDIT COMMITTEE | |

Current Members:

Meetings in

| The Audit Committee assists the Board of Directors in fulfilling its oversight functions with respect to matters involving financial reporting, independent and internal audit processes, disclosure controls and procedures, internal controls over financial reporting, related-party transactions, employee complaints, cybersecurity and risk management. In particular, the Audit Committee is responsible for:

• appointing, retaining, compensating and evaluating the Company’s independent auditors; • reviewing and discussing with management and the independent auditors the Company’s annual and quarterly financial statements, and accounting policies; • reviewing the effectiveness of the Company’s internal audit procedures and personnel; • reviewing, evaluating and assessing the Company’s risk management programs, including with respect to cybersecurity; • reviewing the Company’s policies and procedures for compliance with disclosure requirements concerning conflicts of interest and the prevention of unethical, questionable or illegal payments; and • making such other reports and recommendations to the Board of Directors as it deems appropriate.

The Board of Directors has determined that each Audit Committee member meets the standards for independence required by the New York Stock Exchange (the “NYSE”) and applicable SEC rules. Moreover, it has determined (i) that all members of the Audit Committee are financially literate; and (ii) that |

| COMPENSATION AND | |

Current Members:

Scott J. Goldman

Meetings in 5 |

• providing assistance to the Board of Directors in discharging the Board of Directors’ responsibilities related to • making such recommendations to the Board of Directors as it deems appropriate.

|

| NOMINATING AND | |

Current Members:

Meetings in

| The Nominating and

• recommending director nominees to the Board of Directors; • recommending committee assignments and responsibilities to the Board of Directors; • overseeing the evaluation of the Board of Directors and management effectiveness; • developing and recommending to the Board of Directors corporate governance guidelines; • reviewing •

|

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 15

The Board of Directors has currently implemented a leadership structure in which Mr. Christopher serves as both Chief Executive Officer and Chairman of the Board. The Board has determined that having Mr. Christopher serve in this dual capacity is in the best interest of stockholders at this time. The Company believes that this structure currently allows ultimate leadership and accountability to reside in a single individual, who has both extensive knowledge of the Company’s business and critical relationships with the Company’s customer base.

In order to coordinate the activities of the independent members of the Board of Directors, and to liaise between such directors and the Chairman of the Board, the Company has currently designated Mr. Hermanson to serve as Lead Independent Director. The Lead Independent Director’s responsibilities are set forth in a formal charter, which can be obtained free of charge from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder.

— BOARD’S ROLE IN RISK OVERSIGHT

The Board of Directors is actively involved in oversight of risks that could affect the Company. These efforts can be summarized as follows:

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 16

The Board of Directors has adopted various policies, including a comprehensive set of Corporate Governance Guidelines, by which the Company is governed. These policies are designed to promote sound corporate governance and prudent stewardship of the Company, both by the Board of Directors and management.

The Corporate Governance Guidelines include amendments adopted in February 2020 that prohibit the future pledging of the Company’s common stock as security under any obligation by our directors and executive officers.

The Company maintains a policy which(which was recently updated in February 2023) that mandates compliance with insider trading laws and institutes safeguards to mitigate the risk of insider trading. Further, the Corporate Governance Guidelines prohibit any director, officer or employee of the Company from engaging in short sales, transactions in derivative securities (including put and call options), or other forms of hedging and monetization transactions, such as zero-cost collars, equity swaps, exchange funds and forward sale contracts, that allow the holder to limit or eliminate the risk of a decrease in the value of the Company’s securities.

Under the Corporate Governance Guidelines, if the Company is required to restate its financial results due to material noncompliance with financial reporting requirements under the securities laws as a result of an executive’s (i.e., a President or Vice President level officer’s) willful, knowing or intentional misconduct or gross negligence (as determined by the Compensation and Stock OptionPersonnel Development Committee), the Company may take action to recoup from the executive all or any portion of an incentive award received by the executive, the amount of which had been determined in whole or in part upon specific performance targets relating to the restated financial results. In such an event, the Company shall be entitled to recoup up to the amount, if any, by which the incentive award actually received by the executive exceeded the payment that would have been received based on the restated financial results, as determined by the Compensation and Stock OptionPersonnel Development Committee. The Company’s right of recoupment pursuant to this policy applies to incentive awards received during the three-year period preceding the date on which the Company is required to prepare the restatement, based on the determination of the Company’s independent registered public accounting firm.

The Company has adopted a Code of Business Conduct and Ethics, which is designed to help officers, directors and employees resolve ethical issues in an increasingly complex business environment. The Code of Business Conduct and Ethics is applicable to all of the Company’s officers, directors and employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. The Code of Business Conduct and Ethics covers topics, including but not limited to, conflicts of interest, confidentiality of information and compliance with laws and regulations.

It is the duty of the Board of Directors to serve as prudent fiduciaries for stockholders and to oversee the management of the Company’s business. Accordingly, the Corporate Governance Guidelines include specifications for director qualification and responsibility, attendance, access to officers and employees, compensation, orientation, continuing education and self-evaluation.

The Company’s policy is that all members of the Board of Directors attend annual meetings of stockholders, except where the failure to attend is due to unavoidable circumstances or conflicts discussed in advance with the Chairman of the Board. Because of travel restrictions and safety concerns related to the COVID-19 pandemic, the Chairman was present but excused all non-management members of the Board of Directors from attending the 20202022 annual meeting of stockholders in person.

Where to Find Our Key Governance Policies: The Corporate Governance Guidelines and Code of Business Conduct and Ethics can be obtained free of charge from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder. |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 17

Any stockholder or interested party who wishes to communicate with the Board of Directors, or specific individual directors, including the non-management directors as a group, may do so by directing a written request addressed to such directors or director in care of the Chairman of the Nominating and Corporate Governance Committee, Mueller Industries, Inc., 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. Communication(s) directed to the Chairman will be relayed to him, except to the extent that it is deemed unnecessary or inappropriate to do so pursuant to the procedures established by a majority of the independent directors. Communications directed to non-management directors will be relayed to the intended director except to the extent that doing so would be contrary to the instructions of the non-management directors. Any communication so withheld will nevertheless be made available to any non-management director who wishes to review it.

Related party transactions may present potential or actual conflicts of interest, and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Management carefully reviews all proposed related party transactions (if any), other than routine banking transactions, to determine if the transaction is on terms comparable to those that could be obtained in an arms-length transaction with an unrelated third party. Management reports to the Audit Committee, and then to the Board of Directors on all proposed material related party transactions. Upon the presentation of a proposed related party transaction to the Audit Committee or the Board of Directors, the related party is excused from participation in discussion and voting on the matter.

The Company assesses and manages environmental, social and governance (“ESG”) considerations that may be material to the long-term sustainability of our business. In February 2021,Pursuant to its charter, the Nominating and Corporate Governance Committee’s charter was formally amended to include the management of ESG risk within the Committee’s jurisdiction. In that spirit, the Nominating and Corporate Governance Committee shall beis responsible for reviewing and discussing with management the Company’s implementation of procedures for identifying, assessing, monitoring, managing and reporting on the ESG and sustainability risks and opportunities related to the Company’s business. In so doing, it may form subcommittees or delegate responsibility to other Board Committees or the full Board of Directors as it deems appropriate. Among other matters, we focus on such issues as workplace health and safety, environmental stewardship, business ethics and compliance, supply chain management and the development of human capital. We also focus outwardly on the communities in which we operate, including through a foundation that makes charitable contributions to various causes and organizations. ESG-related risks and opportunities are integral to our strategic decision-making. Such matters are addressed by senior management and subject to the oversight of the Nominating and Corporate Governance Committee and the full Board of Directors. The Company is also prioritizingprioritizes the enhanced reporting and disclosure of the ESG-related risks and opportunities relating to its business and associated metrics, andmetrics. Since 2021, the Company has published its first sustainabilityan annual Sustainability Report. The report which is available on the Company’s website.

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 18

|

|

Our non-employee director compensation for 20202022 was awarded in a combination of cash and equity, as shown below.below:*

| Annual fee for the LeadIndependent Director. | For serving as Lead Independent Director, Mr. Hermanson received an annual fee of $90,000. |

| Annual fee for other directors | All other non-employee directors received an annual fee of |

| Discretionary Bonus | All non-employee directors received a discretionary bonus of $10,000. |

| Meeting fees | • $3,000 per full Board meeting attended• $3,000 per Audit Committee meeting attended• $1,000 per Compensation and |

| Annual fees for CommitteeChairs | • $25,000 for the Audit Committee Chair |

• $ | |

| Annual equity award | • All non-employee directors |

*In his capacity as Chairman of the Board of Directors, Mr. Christopher received neither a retainer nor any meeting fees.

In addition, each director received reimbursement for such director’s expenses incurred in connection with any such Board or Committee meeting, and each Committee fee was paid whether or not such committee meeting was held in conjunction with a Board of Directors meeting.

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 19

The table below summarizes the total compensation we paid to our non-employee directors for the fiscal year ended December 26, 2020.31, 2022.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | (1) | Option Awards ($) | (1) | All Other Compensation ($) | (2) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($) | (1) | Other Compensation ($) | (2) | Total ($) | ||

| Elizabeth Donovan | 77,000 | 48,660 | 27,230 | 10,800 | 163,690 | 85,000 | 167,040 | 11,280 | 263,320 | |||||||

| Paul J. Flaherty | 38,000 | — | — | 32,600 | 70,600 | |||||||||||

| William C. Drummond | 94,000 | 167,040 | 10,000 | 271,040 | ||||||||||||

| Gennaro J. Fulvio | 118,000 | 48,660 | 27,230 | 10,800 | 204,690 | 37,000 | — | 1,280 | 38,280 | |||||||

| Gary S. Gladstein | 84,000 | 48,660 | 27,230 | 10,800 | 170,690 | 81,000 | 167,040 | 11,280 | 259,320 | |||||||

| Scott J. Goldman | 96,000 | 48,660 | 27,230 | 10,800 | 182,690 | 94,000 | 167,040 | 11,280 | 272,320 | |||||||

| John B. Hansen | 95,000 | 48,660 | 27,230 | 10,800 | 181,690 | 121,000 | 167,040 | 11,280 | 299,320 | |||||||

| Terry Hermanson | 103,000 | 48,660 | 27,230 | 10,800 | 189,690 | 105,000 | 167,040 | 11,280 | 283,320 | |||||||

| Charles P. Herzog, Jr. | 86,000 | 48,660 | 27,230 | 10,800 | 172,690 | 90,000 | 167,040 | 11,280 | 268,320 | |||||||

| (1) | Represents the aggregate grant date fair value of awards granted to our directors in |

| (2) | Other cash compensation included (i) a $10,000 cash award provided to our non-employee directors |

| (3) | Mr. |

—

STOCK OWNERSHIP POLICY FOR DIRECTORS

To further align the Company’s goal of aligning directors’ economic interests with those of stockholders, the Company has adopted stock ownership guidelines for its non-employee directors recommending that they hold equity interests of the Company (including vested and unvested interests, provided that with respect to options, only vested options that are exercisable within 60 days of the applicable measurement date will be counted) with a value equal to three times the annual cash director fee payable to each such director. All directors are expected to comply with the stock ownership guidelines within five years of being elected to the Board of Directors, and current directors should comply as soon as practicable. Director compliance with the stock ownership guidelines is monitored on an ongoing basis by the Company’s General Counsel.

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 20

| PROPOSAL 2 |

The Audit Committee has reappointed Ernst & Young LLP (“EY”) to audit and certify the Company’s financial statements for the fiscal year endingended December 25, 2021,31, 2022, subject to ratification by the Company’s stockholders, which requires the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting. If the appointment of EY is not so ratified, the Audit Committee will reconsider its action and will appoint auditors for the 20212023 fiscal year without further stockholder action. Notwithstanding, the Audit Committee may at any time in the future in its discretion reconsider the appointment without submitting the matter to a vote of stockholders. Representatives of EY are expected to attend the Annual Meeting to answer questions and make a statement if they so choose.

Fees for EY’s audit and other services for each of the two fiscal years ended December 26, 202031, 2022 and December 28, 201925, 2021 are set forth below:

| 2020 | 2019 | 2022 | 2021 | |||||||||||||

| Audit Fees (professional services rendered for the audit of (i) the Company’s consolidated annual and interim/quarterly financial statements, and (ii) internal controls over financial reporting) | $ | 2,749,755 | $ | 2,856,774 | $ | 3,298,330 | $ | 3,096,955 | ||||||||

| Audit-Related Fees (assurance and other services, including international accounting and reporting compliance) | 47,000 | 50,250 | $ | 53,000 | $ | 74,000 | ||||||||||

| Tax Fees (tax compliance, advice and planning) | 406,000 | 422,350 | $ | 617,000 | $ | 660,000 | ||||||||||

| All Other Fees | — | — | — | — | ||||||||||||

| $ | 3,202,755 | $ | 3,329,374 | $ | 3,968,330 | $ | 3,830,955 | |||||||||

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent auditors. Pre-approval is generally provided for up to one year, and any such pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated pre-approval authority to its Chairman when expedition of services is necessary. The independent auditors and management are required periodically to report to the full Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. All of the services provided by the independent auditors during fiscal years 20202022 and 2019,2021, respectively, under the categories Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees described above were pre-approved.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 21

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 1301. In addition, the Audit Committee discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by Public Company Accounting Oversight Board’s Rule 3526, and considered the compatibility of non-audit services provided by the independent auditors with the auditor’s independence.

The Audit Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 26, 202031, 2022 for filing with the SEC. The Audit Committee and the Board has re-appointed, subject to stockholder approval, Ernst & Young LLP, independent auditors, to audit the consolidated financial statements of the Company for the fiscal year ending December 25, 2021.30, 2023.

The Audit Committee is governed by a formal charter which can be accessed from the Company’s website at www.muellerindustries. com,www.muellerindustries.com, or may be requested in print by any stockholder. The members of the Audit Committee are considered independent because they satisfy the independence requirements for Board members prescribed by the NYSE listing standards and Rule 10A-3 of the Exchange Act.

Gennaro J. Fulvio, ChairmanScott J. Goldman

John B. Hansen, Chairman

William C. Drummond

Charles P. Herzog, Jr.

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, and irrespective of any general incorporation language in any such filing. |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 22

| PROPOSAL 3 |

In accordance with Section 14A of the Exchange Act, stockholders are being asked to vote on an advisory, non-binding basis, on the compensation of the Company’s named executive officers. Specifically, the following resolution will be submitted for a stockholder vote at the Annual Meeting, the approval of which will require the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting and entitled to vote thereon:

“RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers listed in the 20202022 Summary Compensation Table included in the proxy statement for the 20212023 Annual Meeting, as such compensation is disclosed pursuant to Item 402 of Regulation S-K in this proxy statement under the section titled “Compensation Discussion and Analysis,” as well as the compensation tables and other narrative executive compensation disclosures thereafter.”

Although the stockholder vote is not binding on either the Board of Directors or the Company, the views of stockholders on these matters are valued and will be taken into account in addressing future compensation policies and decisions.

The Company’s Compensation and Stock OptionPersonnel Development Committee is comprised of knowledgeable and experienced independent directors, who are committed to regular review and effective oversight of our compensation programs. The Company’s executive compensation program is grounded in a pay for performance philosophy, and accordingly, has been designed to motivate the Company’s key employees to achieve the Company’s strategic and financial goals, and to support the creation of long-term value for stockholders. Moreover, given the particularly competitive markets in which we operate and the nature of our business, a principal goal underlying the Company’s long-term incentive compensation program specifically is the long-term retention and motivation of critical executives and business leaders.leaders, to ensure that the Company will continue to benefit from an exceptionally strong leadership team that will be well positioned to develop sound transition and succession plans for its key executives as such needs arise in the future. The Company’s success depends upon their leadership, judgment and experience, and as such, our compensation program is designed to promote their enduring commitment to the Company. We encourage stockholders to read the Executive Compensation section of this proxy statement, including the Compensation Discussion and Analysis (CD&A) and compensation tables, for a more detailed discussion of the Company’s compensation programs and policies, and how they are appropriate and effective in promoting growth, creating value, and retaining key members of our team.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS. |

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 23

| COMPENSATION DISCUSSION AND |

| EXECUTIVE SUMMARY | 24 | ||

| DETERMINATION OF EXECUTIVE COMPENSATION | 26 | ||

| ELEMENTS OF COMPENSATION | |||

| COMPENSATION RISK MANAGEMENT | 32 |

This Compensation Discussion and Analysis (“CD&A”) provides an overview of how our named executive officers were compensated in 2020,2022, as well as how this compensation furthers our established compensation philosophy and objectives.

The Company’s NEOs for fiscal year 20202022 were:

We believe in a pay for performance philosophy, such that a material portion of a named executive officer’s compensation is dependent upon both the short-term and long-term strategic and financial performance of the Company, considered in light of general economic and specific Company, industry, and competitive conditions. For 2020,2022, we continued to reward named executive officers in a manner consistent with this philosophy by setting annual incentive targets based on the Company’s achievement of certain levels of operating income. While also rooted in a pay for performance philosophy, our long-term equity incentive compensation program is focused primarily on promoting the retention of key executives and business leadersleaders.

We believe that our long-term equity incentive compensation program serves as a valuable tool for recruitment and retention in our industry, where the competition for leadership talent is a foremost concern.concern, as well as for ensuring sound and smooth succession and transition planning for our NEOs. Accordingly, we continued to grant equity awards, such that any long-term compensation opportunity will be directly tied to stock performance, and will only be received by key executives and business leaders who remain with and make long-term commitments to the Company’s success. The Compensation and Stock OptionPersonnel Development Committee (hereinafter referred to as “the Committee” for purposes of this CD&A section) evaluates, on an annual basis, the overall structure and design of our program, and believes it has and continues to reflect the best balance of the Company’s priorities.

MUELLER INDUSTRIES • 2021● 2023 PROXY STATEMENT 24

Our pay and equity programs are designed to align executives’ interests with those of our stockholders, and to motivate and retain critical leaders. Below is a snapshot of our compensation practices:

| WHAT WE DO | WHAT WE DON’T DO | |||

| We maintain a fully independent Compensation and |   | We do not provide for single trigger severance upon a change in control. | |

| A higher percentage of our executives’ compensation is variable rather than fixed. |   | We do not permit gross-up payments to cover excise taxes. | |

| We utilize varying performance metrics under our short-term and long-term incentive plans. |   | We do not permit the pledging or hedging of our common stock. | |

| Our annual incentive program is based on earnings performance and capped for maximum payouts. |   | We do not support compensation programs or policies that reward material or excessive risk taking. | |

| Our equity awards include extended vesting schedules and performance-based criteria. |   | We do not maintain any supplemental executive retirement plans. | |

| We have a clawback policy applicable to all senior employees, including all President and Vice President level personnel. | |||

2020

At our 20202022 Annual Meeting, we held our annual non-binding stockholder advisory vote on executive compensation. Approximately 77%89% of our shares voted (excluding abstentions and broker non-votes) were in favor of the compensation of our named executive officers as disclosed in the proxy statement for the 20202022 Annual Meeting.

Last year, in response to stockholder feedback, the Company not only endeavored to more clearly and fully present its compensation program, but also to dramatically revamp the look, format and substance of the 2020 proxy statement. Our goal in doing so was to provide a more useful tool to assist stockholders in evaluating our compensation program, including pay-for-performance alignment and whether it serves the vital strategic goal of attracting and retaining key executives in the competitive markets in which we participate. We were gratified that last year’sby the level of stockholder support received in 2022 for our non-binding stockholder advisory vote on executive compensation, and believe it reflected an improvement in support, but it was clear that there was more work to do in this regard.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 25

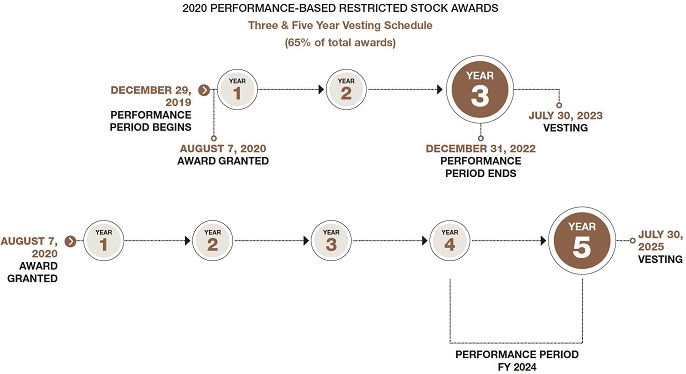

Accordingly, weour continued efforts to engage with stockholders regarding the Company’s compensation practices and the philosophies underlying them. Those discussions afforded stockholders the opportunity to raise questions and concerns regarding theon executive compensation program as presented in last year’s proxy solicitation. One specific aspectmatters. In 2022, we sought to further improve our pay-for-performance alignment by making 100% of the compensation program that was a particular focus was our long-term equity incentive program, and how the performance-based criterion underlying thosetotal equity awards were chosengranted to emphasize long-term strategic growthour Chief Executive Officer and to serve as a complement to the Company’s ambitious targets underlying its annual cash incentive program in an effort to create a balanced and well-rounded incentive structure. In response to that feedback, the Company implemented two reforms in 2020:other NEOs, performance-based.

As in prior years, the | |

The Committee will consider the outcome of this year’s stockholder advisory vote on executive compensation as it makes future compensation decisions.

In July 2022, the Compensation and Personnel Development Committee retained Willis Towers Watson (“Willis Towers”) to (i) conduct an independent review of the total compensation of each of our NEOs based on peer group pay and industry survey data; and (ii) to independently advise the Committee on the performance-based special equity award grant to our CEO in November 2022, as discussed under “CEO Special Retention Grant” below, to facilitate the retention of our CEO in connection with the Company’s broader succession planning.

MUELLER INDUSTRIES● 2023 PROXY STATEMENT 25

During 2022, Willis Towers’ aggregate fees in connection with advice relating to executive compensation were $64,523. In addition to the engagement described above, Willis Towers provided insurance and health care related consulting services in 2022, and in so doing, billed the Company for fees totaling $194,641. Requests for non-executive compensation consulting services are made to Willis Towers by persons below the executive officer level within the departments of our Company that have a need for such services, and those requests are made without the involvement of our senior management or other personnel who may be associated with Willis Towers’ executive compensation consulting.

The Committee assessed the independence of Willis Towers and, based on this assessment, the Committee determined that, given the nature and scope of these additional services, these additional services did not raise a conflict of interest and did not impair Willis Towers’ ability to provide independent advice to the Committee concerning executive compensation matters.

Guided by the philosophy and design outlined above, the Committee determines the compensation of our Chief Executive Officer. In turn, our Chief Executive Officer makes recommendations to the Committee regarding all components of our other NEOs’ compensation, including base salary, annual cash incentive compensation, and long-term equity incentive compensation. The Committee considers and acts upon those recommendations in setting the compensation of our other NEOs.

In determining compensation, we generally do not rely upon hierarchical or seniority-based levels or guidelines, nor did the Committee formally benchmark executive compensation (or any component thereof) against any particular peer group. Instead, we utilize a more flexible approach that allows us to adapt components and levels of compensation to motivate and reward individual executives within the context of our broader strategic and financial goals. This requires that we consider subjective factors including, but not limited to the following:

| • | The nature of the executive’s position; |

| • | The performance record of the executive, combined with the value of the executive’s skills and capabilities in supporting the long-term performance of the Company; |

| • | The Company’s overall operational and financial performance; and |

| • | Whether each executive’s total compensation potential and structure is sufficient to ensure the retention of the executive officer when considering the compensation potential that may be available |

In making compensation decisions, the Committee relies on the members’ general knowledge of our industry, supplemented by advice from our Chief Executive Officer based on his knowledge of our industry and the markets in which we participate. From time to time, we conduct informal analyses of compensation practices and our Compensation and Stock OptionPersonnel Development Committee may review broad-based third-party surveys to obtain a general understanding of current compensation practices. In addition, in 2022, our Compensation and Personnel Development Committee reviewed and considered the results of the independent review conducted by Willis Towers of the total compensation of each of our NEOs, based on peer group pay and industry survey data, but did not implement any changes to 2022 compensation based on the Willis Towers report.